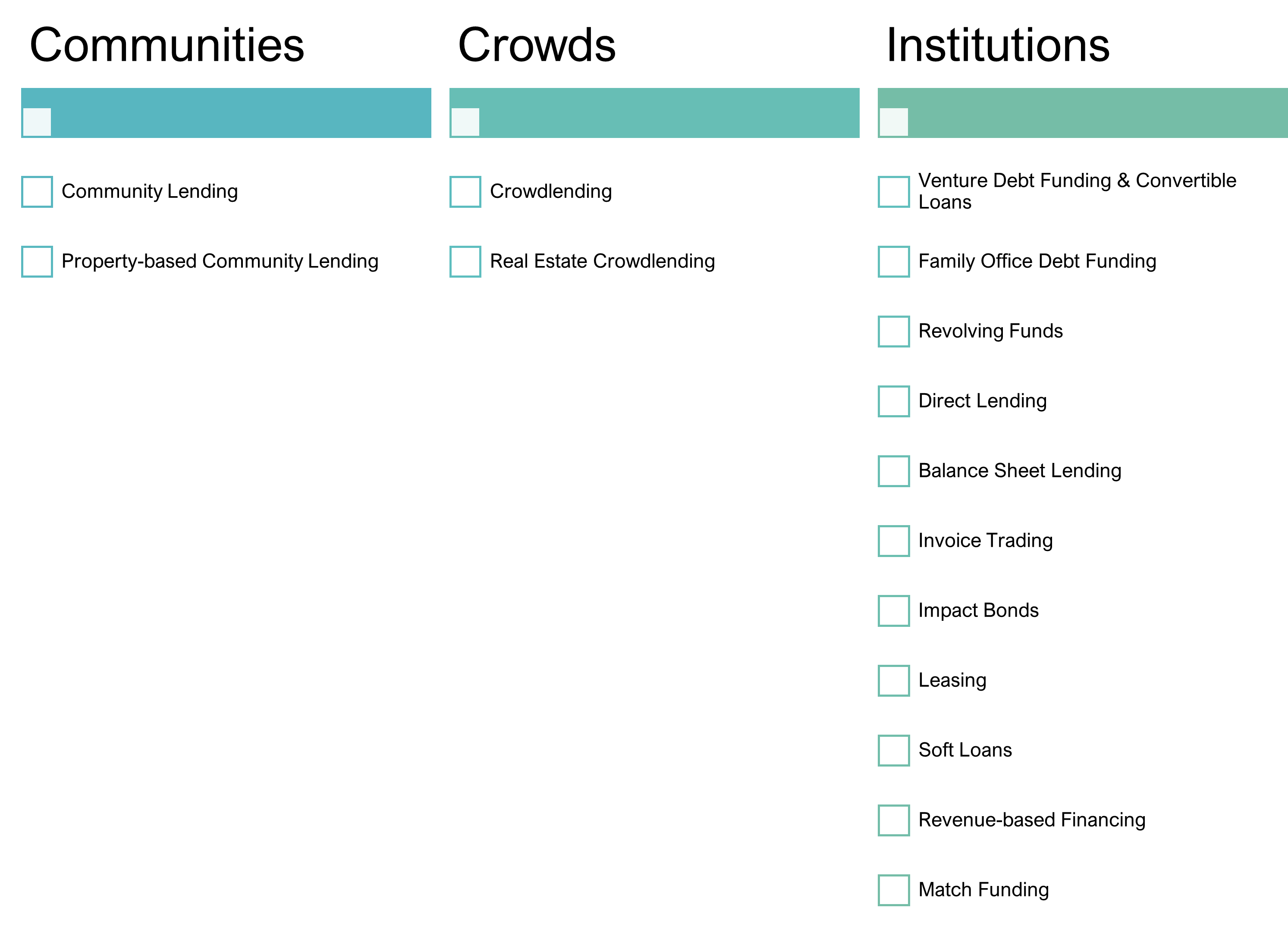

Institutional funding

Institutional funding includes venture capital and bank financing but also any other funds made available by companies, charities, governments and family offices.

Venture debt funding and convertible loans

Venture debt funding is the typical investment form for companies needing 500.000 up to 10 million euro. Usually loans are provided to companies that have reached their scale-up phase. Venture capital and debt funds typically manage the funds of other people, focus on specific industries and often operate across borders. They can be easily contacted but competition is high.

Convertible loans can be converted into equity based on a specified number of shares. In mezzanine financing the interest rate depends on the success of the company and thus allows for more flexibility.

Family office debt funding

Family offices are an atypical kind of fund. These funds manage the capital of wealthy families and are more flexible than other funds. Apart from regular loans they may provide all kinds of financing solutions including grants and investments. A personal introduction is important to get access to a family office.

Revolving funds

The most ‘circular’ funding models are the revolving funds. These funds usually operate in specific sectors such as sustainable energy. After receiving an initial amount from shareholders, donors or creditors they operate on reusing the reimbursements of investments made and loans provided. This way a continuous cycle of investments in projects under s similar scope is established, and deep knowledge on what works in a given sector is generated. Successful project owners know that their success generates new opportunities and expands their impact.

Direct lending

In direct lending, a financing intermediary gives out a debt instrument to investors. The incoming funds are used to finance projects and companies directly. Investors receive a fixed monthly or yearly interest. Direct lending allows investors to spread their risk as their money gets combined and then spread out across multiple projects. This is also called debt financing, or third party financing as the investor has no direct relationship with the projects and companies the money is invested in.

Balance sheet lending

In balance sheet lending, the (online digital ) platform or investment fund provides direct loans to individuals or business borrowers, possibly secured against a property. The difference with direct lending is that the funding comes directly from the balance sheet of the investment company. With direct lending the platform is just the matchmaker and intermediair between the investors and company. Balance sheet lending works therefore similar for an entrepreneur then applying for a bank loan, but tends to be faster. The financial statements can for example be partially checked by an algorithm and the decision making process can be one quicker due to less levels of agreement needed.

Invoice trading

Funders purchase invoices from businesses at a discounted rate. This can be done on a traditional way by including all invoices or by selling individual invoices (American Factoring)

Impact bonds

When investors seek to achieve specific non-financial goals they may issue impact bonds. These are debt instruments that may operate without interest. In impact bonds the investors take on the additional risk of a project, and the government payout after the project depends on its success. These can be measurable impacts or cost-savings.

Impact bonds are an ideal way to reduce the risk for the government by letting the market take on the risk of achieving success. Examples are green bonds, related to the sustainable energy transition, or social impact bonds, related to specific social goals. Normally these impact bonds are executed by large investors due to the complexity of the proposal and conditions.

Leasing

Leasing is a specific form of lending. The lessee (end-user) obtains the use of assets and pays periodic payments in return. The lessor receives the payment and is responsible for the asset and any associated costs. Also in a financial lease, the lessee uses the asset for the duration of the lease agreement, while the lessor maintains ownership.

Soft loans

Soft loans are loans below market rates. Usually these also have longer payback periods and tend to be derived from public funding to facilitate investments.

Revenue based financing

Another surprising reward-based financing model is revenue-based financing. This ‘founder-friendly’ loan acts like equity. It shares the risk and does not have to be repaid in a predetermined structure. Yet the investor receives no shares or voting rights as is common in loan-agreements. Instead a percentage of turnover is agreed to repay the loan. A cap can be implemented to limit the total amount that has to be repaid.

Match funding

In match funding, governments or other organizations match the funding generated by other investors. It can be done in all forms of capital but the most common forms of government involvement are grants, subsidies and guarantees.[1] Governments may also co-invest in a public-private investment fund which in turn invests in projects and businesses.

[1] CrowdThermal D3.2