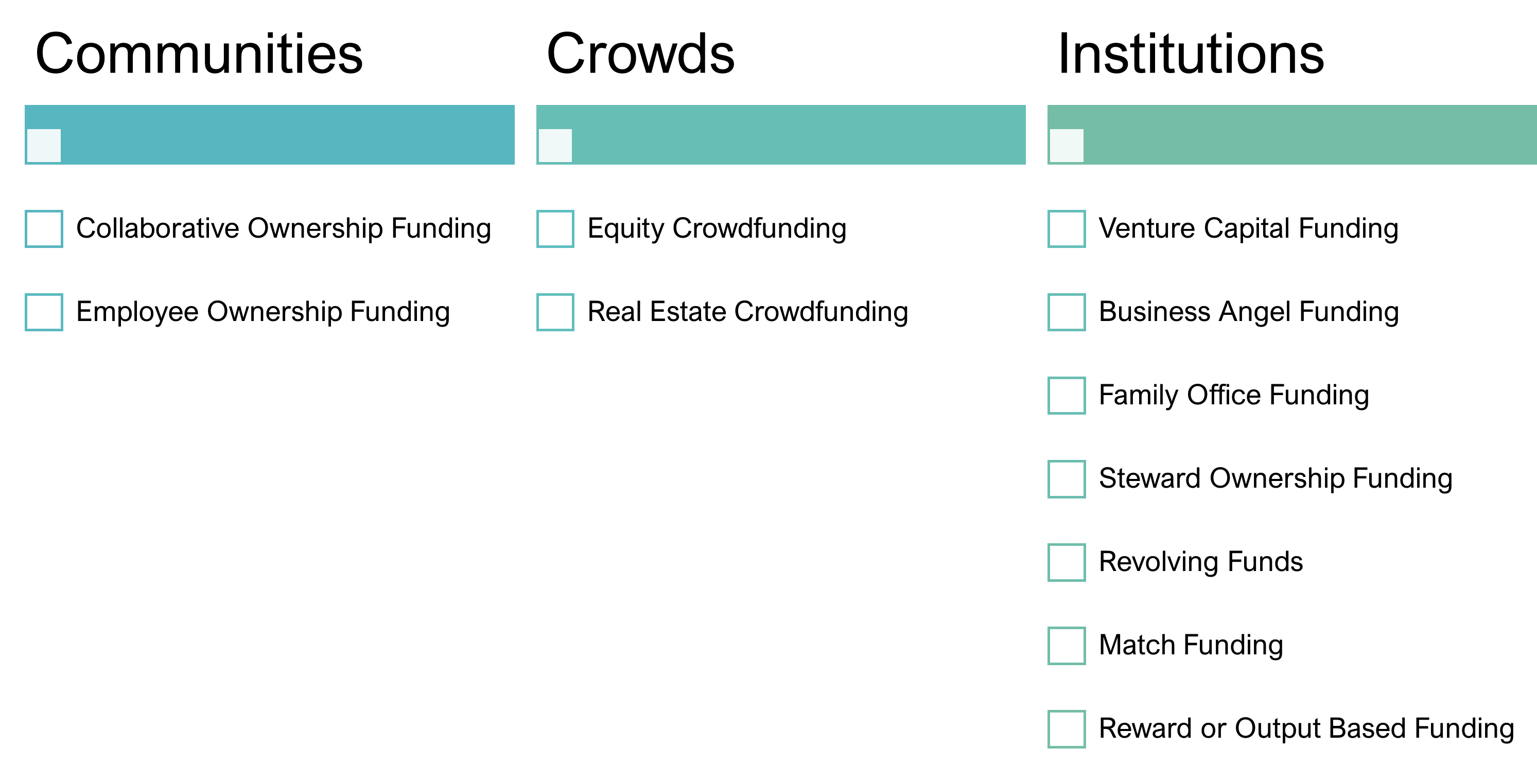

Institutional funding

Institutional funding includes venture capital but also any other funds made available by companies, charities, governments, banks or others such as family offices.

Venture capital funding and convertible loans

Venture capital is the typical investment form for companies needing 500.000 up to 10 million euro. These funds typically manage the funds of other people, focus on specific industries and often operate across borders. They can be easily contacten but competition is high. In some cases, convertible loans are issued. These can be converted into equity based on a predetermined number of shares.

Business Angel funding

Business angels are private individuals who make early stage investments in equity of a company. They usually invest between 50.000 and 500.000 euro and tend to combine their financial investment with coaching the founders of the company. Often these are successful entrepreneurs themselves who can be reached through local angel business networks, or ideally through a personal introduction. Regularly business angels co-invest with other business angels and tend to invest in sectors where they already have experience.

Family office funding

Family offices are an atypical kind of fund. These funds manage the capital of wealthy families and are more flexible than other funds. Apart from regular funding they may provide all kinds of financing solutions including grants and loans. A personal introduction is important to get access to a family office.

Steward ownership funding

Steward ownership funding is best described by what it is not. First of all it is not intended as a wealth-building engine for investors, and it is not a commodity that can be traded, Instead it is designed to let the entity that gets the funding to be permanently independent. This purpose driven entity operates on a clearly predetermined purpose and rules safeguarded by the ‘stewards’ of the company. Investors, owners and other stakeholders share the voting rights in case of major decisions. The management is dedicated to the shared mission and profit is invested back into the company or donated to achieve a higher impact. The maximal return on investment for the investors is also predetermined and is usually capped to avoid profit maximisation and protect the company's mission. Often a ‘golden share’ is implemented that can veto any decisions that would negatively impact the company goals. Steward ownership funding combines the equity with the capped reward that is common in debt financing. Investors lose earning potential and control but potentially work with a team that tends to be highly motivated and mission driven.

Revolving funds

The most ‘circular’ funding models are the revolving funds. These funds usually operate in specific sectors such as sustainable energy. After receiving an initial amount from shareholders, donors or creditors they operate on reusing the reimbursements of investments made and loans provided. This way a continuous cycle of investments in projects under s similar scope is established, and deep knowledge on what works in a given sector is generated. Successful project owners know that their success generates new opportunities and expands their impact.

Match funding

In match funding, governments or other organizations match the funding generated by other investors. It can be done in all forms of capital but the most common forms of government involvement are grants, subsidies and guarantees.[1] Governments may also co-invest in a public-private investment fund which in turn invests in projects and businesses.

Reward or output based funding

Public and private investors might also invest in exchange for a non-financial reward. The most common form is outcome based financing or ‘outcome grants’ where the funds pay money for any pre-negotiated impact that is achieved (institutional funding). Contrary to the previous models the money is not usually not paid upfront, but after the impact has been achieved. This is a combination of investing and reward seeking.

[1] CrowdThermal D3.2